Korean Economy

1. Korea’s GDP Growth in the Third Quarter of 2025

In the third quarter of 2025, Korea’s real gross domestic product (GDP) grew 1.2% from the previous quarter and 1.7% from a year earlier, while real gross domestic income (GDI) increased 0.7%.

From the expenditure side of GDP, private consumption increased 1.3%, supported by higher spending on both goods (such as passenger cars and communication devices) and services (including dining and healthcare). Government consumption expanded 1.2%, mainly due to higher expenditures on goods and health insurance benefits. Construction investment edged down 0.1%, reflecting weaker building construction, while facilities investment rose 2.4%, driven by machinery such as semiconductor manufacturing equipment. Exports grew 1.5%, led by semiconductors and automobiles, and imports increased 1.3%, centered on machinery, equipment, and automobiles.

<Gross Domestic Product by Economic Activity>

(At 2020 Constant Prices)

(Seasonally Adjusted, Quarter-on-Quarter % Change, with Year-on-Year % Change in Parentheses)

(Source: Bank of Korea, Oct 28, 2025)

-

Wholesale & retail trade, accommodation & food service, transportation, finance & insurance, real estate, information & communications, business services, public administration, education, healthcare & social welfare, culture, and other services are included under “Services.”

-

Figures in parentheses indicate year-on-year growth rates based on non-seasonally adjusted data.

By economic activity, agriculture, forestry, and fishing declined 4.8%, mainly due to weaker crop production, while manufacturing grew 1.2%, led by transportation equipment, computers, and electronic and optical devices. Electricity, gas, and water supply rose 5.6%, driven by the electricity sector. Construction remained flat as an increase in civil engineering was offset by a decrease in building construction. Services expanded 1.3%, mainly supported by wholesale and retail trade, accommodation and food services, and finance and insurance.

Real gross domestic income (GDI) increased 0.7%, falling short of the 1.2% growth in real gross domestic product (GDP).

2. Outlook for the Korean Economy in 2026

1) Overview

Following growth of 0.9% in 2025, the Korean economy is projected to expand by 1.6% in 2026.

Although construction investment has remained sluggish this year, the second supplementary budget, improving consumer sentiment, and robust semiconductor-driven exports have acted as stabilizing buffers, and growth is assessed to have shown a clear recovery compared with the previous year.

Despite a sharper-than-expected decline in construction investment in the second quarter, the economy rebounded from a 0.2% contraction in the first quarter to 0.6% growth in the second, supported by stronger private consumption and resilient exports. Growth in the third quarter is expected to reach a solid 1.1%, exceeding the initial forecast of 0.7%, driven by the rollout of consumption coupons and strong semiconductor exports. However, toward the year-end, export growth is expected to ease to around 0.2% in the fourth quarter as exports of U.S. tariff-affected items such as steel and automobiles weaken.

In 2026, the economy is forecast to grow 1.6%, as the impact of U.S. tariff policies becomes more pronounced and global economic growth slows, limiting the expansion of Korea’s exports.

Korea’s Growth Outlook

2) Inflation Outlook

The consumer price inflation rate is projected to record 2.0% in 2025, followed by 1.9% in 2026. This is because, despite lower global oil prices, adverse weather conditions have driven up prices of agricultural, livestock, and fishery products, adding some upward pressure on inflation.

3) Current Account Outlook

The current account surplus is projected at USD 110 billion in 2025 and USD 85 billion in 2026. In 2025, the goods account surplus is expected to widen, supported by strong semiconductor exports and a moderate impact from U.S. tariffs. The primary income account is also projected to maintain a solid surplus, driven by investment income amid an expansion of net external assets and a recovery in global financial markets.

4) Labor Market Outlook

The number of employed persons is projected to increase by 170,000 in 2025 and 130,000 in 2026.

While employment in construction and manufacturing is expected to continue declining due to weak construction investment and reduced profitability in manufacturing stemming from U.S. tariff policies, service sector employment is likely to outperform earlier expectations, supported by government job creation programs and improving consumer demand. Older workers are expected to lead overall job growth, while youth employment conditions are anticipated to improve modestly in line with the domestic demand recovery.

Inflation, Current Account, and Employment Outlook

(Source: Bank of Korea, Statistics Korea)

5) Overall Assessment

In summary, despite persistent weakness in the construction sector, the Korean economy in 2025 is projected to grow 0.9%, slightly exceeding the earlier forecast of 0.8%, supported by the supplementary budget, improving consumer sentiment, and a rebound in semiconductor exports. Inflation is expected to remain stable at around 2%, while the current account surplus is set to expand and employment conditions continue to improve.

Domestic demand is expected to continue recovering next year, supported by previous interest rate cuts and an improvements in real income. However, as exports weaken due to the impact of U.S. tariffs, the annual growth rate is projected to reach around 1.6%.

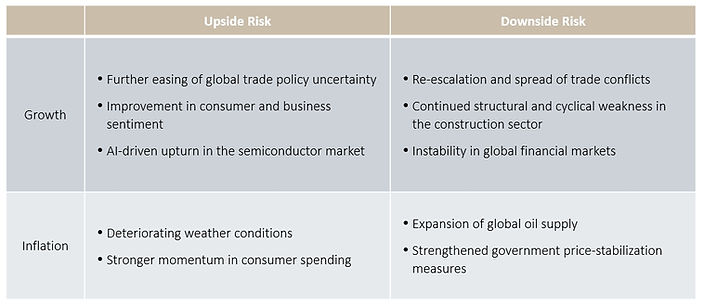

That said, the ramp-up of U.S. tariff policy, a slowdown in global trade, and rising climate-related risks are cited as potential factors that could constrain growth beyond next year.