Korean

Insurance Market

1. Preliminary Business Results of Insurers in Korea for the First Half of 2025

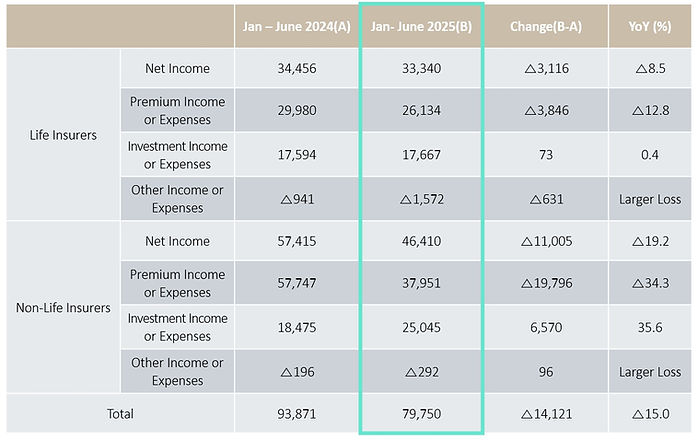

According to the Financial Supervisory Service (FSS), preliminary business results for insurers (22 life insurers and 31 non-life insurers) for the first half of 2025 showed that the industry’s net income stood at KRW 7.98 trillion, representing a 15% (KRW 1.41 trillion) decrease year-on-year. This decline was mainly attributable to the deterioration in underwriting performance driven by higher loss reserves and an increase in the loss ratio.

1) Net Income

In the first half of 2025, life insurers recorded a net income of KRW 3.33 trillion, down KRW 311.6 billion from a year earlier, mainly due to weaker underwriting results stemming from higher loss reserve expenses, while investment income remained largely unchanged. Non-life insurers posted a net income of KRW 4.64 trillion, a KRW 1.10 trillion decrease year-on-year. Although investment results improved, including higher valuation gains on bonds, underwriting performance deteriorated due to a rise in the loss ratio, driving the overall decline.

<Net Income>

(Unit: KRW 100 million, %)

2) Premium Income

Total premium income in the first half of 2025 amounted to KRW 124.38 trillion, up 8.0% (KRW 9.25 trillion) from a year earlier. Both life and non-life sectors recorded growth, although trends varied across lines of business.

For life insurers, premium income totaled KRW 60.16 trillion, representing a 10.4% year-on-year increase. Sales of protection-type (+13.0%), variable (+2.3%), and retirement annuity (+42.4%) products increased, while savings-type (△4.6%) premiums declined.

Non-life insurers generated KRW 64.22 trillion in premium income (+5.9% YoY), driven by growth in long-term (+6.8%), general P&C (+4.1%), and retirement annuity (+15.0%) segments. Motor premiums fell 2.8%.

<Premium Income>

(Unit: KRW 100 million, %)

3) Profitability

In the first half of 2025, the insurance industry’s return on assets (ROA) and return on equity (ROE) stood at 1.24% and 11.26%, respectively, down 0.29%p and 0.44%p from the same period a year earlier.

<ROA and ROE>

(Unit: %, %p)

(Source: Financial Supervisory Service, May 27, 2025)

Total Assets and Shareholder’s Equity

As of the end of June 2025, insurers’ total assets and liabilities amounted to KRW 1,301.8 trillion and KRW 1,160.7 trillion, up 2.6% and 3.0% from end-2024, respectively. Shareholders’ equity fell slightly to KRW 141.0 trillion (–0.8%), mainly reflecting lower interest rates.

<Total Assets and Shareholder’s Equity>

(Unit: KRW trillion, %)

In the first half of 2025, net income declined year on year as underwriting results deteriorated due to higher loss reserve expenses and an increase in the loss ratio, despite improved investment performance. Shareholders’ equity also decreased from the end of the previous year, mainly reflecting lower interest rates. The Financial Supervisory Service (FSS) noted that, amid growing financial market volatility including fluctuations in stock prices, interest rates, and exchange rates, insurance companies need to strengthen the management of their financial soundness.

2. Business Results of Motor Insurance for the First Half of 2025 (Provisional)

Due to a deterioration in the loss ratio, insurance operating profit in the motor insurance sector dropped by more than 90% year on year in the first half of 2025.

According to the Financial Supervisory Service (FSS), total motor insurance premium income for the first half of the year amounted to KRW 10.21 trillion, representing a 2.9% decrease from the same period of the previous year. The FSS explained that the growth of the motor insurance market has slowed in recent years, mainly as a result of premium rate reductions over the past four years.

<Trends in Motor Insurance Business Performance>

(Unit: %, KRW 100 million)

In the first half of 2025, total income from motor insurance amounted to KRW 382.0 billion, down 43.9% from the same period a year earlier. In particular, underwriting income amounted to KRW 30.2 billion, representing a sharp 90.9% year-on-year decline. The loss ratio rose by 3.1%p to 83.3%, reflecting both a decrease in earned premiums due to lower gross written premiums and an increase in medical expenses, especially for traditional Korean medicine treatments. In addition, higher claim payments caused by rising auto parts costs contributed to weaker profitability. As a result, the combined ratio reached 99.7%, nearly hitting the break-even level of 100%.

<Trends in Motor Insurance Loss Ratio and Expense Ratio>

(Unit: %)

The combined market share of the four major non-life insurers (Samsung, Hyundai, KB, and DB) stood at 85.3%, virtually unchanged from the level recorded a year earlier. Mid-sized and smaller insurers (Meritz, Hanwha, Lotte, MG, and Heungkuk) posted a 0.2%p gain to 8.5%, while digital insurers (AXA, Hana, and Carrot) saw their share fall by 0.2%p to 6.4%.

<Trend in Market Share>

(Unit: %, %p)

The FSS stated that “in the second half of the year, potential factors for a worsening loss ratio remain, including heavy rainfall in July and increased traffic during the autumn travel season.” The FSS added, “We will continue to monitor developments in motor insurance loss ratios and business performance, and work to ensure the stable management of loss ratios by preventing unnecessary claims leakage.”

3. K-ICS Ratios of the Korean Insurance Industry as of June 2025

The Financial Supervisory Service (FSS) announced on the 18th that as of the end of June 2025, the capital adequacy ratio (K-ICS ratio) of Korean insurance companies after applying transitional measures reached 206.8%, representing an 8.9%p increase from 197.9% in the previous quarter.

By sector, life insurers recorded 200.9%, an increase of 10.2%p from the previous quarter, while non-life insurers rose 7.0%p to 214.7% over the same period.

<Trends in K-ICS Ratios>

(Unit: %)

Since the end of March 2023, capital adequacy ratios have been calculated under K-ICS after the application of transitional measures.

The FSS analyzed that the available capital of insurers expanded significantly due to an increase in net profit and new issuance of capital securities.

In fact, as of end-June 2025, the available capital under K-ICS after applying transitional measures amounted to KRW 260.6 trillion, up KRW 11.3 trillion from the previous quarter. A breakdown of this increase shows net income of KRW 3.9 trillion, a KRW 3.4 trillion rise in accumulated other comprehensive income driven by higher market interest rates, and the issuance of KRW 2.6 trillion in new capital securities.

During the same period, the increase in required capital was only KRW 60 billion, indicating that the growth of available capital far outpaced that of required capital, thereby improving overall financial soundness.

<Details of Changes in K-ICS Ratios>

(Unit: trillion KRW, %, %p)

(Source: Korea Insurance Research Institute, March 2025)

Given the possibility of interest rate cuts within the year and the likelihood that a low-interest rate trend will continue, the FSS emphasized the importance of continued capital management.

An FSS official said, “Considering the possibility of a prolonged trend of interest rate reductions, it is necessary for insurers to continue their efforts in asset and liability management (ALM). The FSS plans to conduct thorough supervision to ensure that insurers with insufficient ALM management strengthen their risk management capabilities.”

4. Expansion of Digitalized Claims Processing for Medical Expense Insurance through “Silson24”

Beginning on October 25, 2025, the claims submission process for medical expense insurance was further expanded through digitalization. This second-phase rollout extends the system to clinics and pharmacies and follows joint system-readiness assessments conducted by the Financial Services Commission, related agencies, and participating medical institutions.

Phase 1, introduced in October 2024, applied to hospital-level medical institutions and public health centers. In October 2025, Phase 2 was fully implemented, now encompassing clinics and pharmacies. Among a total of 104,541 healthcare providers nationwide, approximately 10,920 healthcare providers (10.4 percent) are currently connected to the “Silson24” system. Connection rates stand at 54.8 percent for Phase 1 and 6.9 percent for Phase 2. As more Electronic Medical Record (EMR) vendors participate, overall connectivity is expected to increase gradually.

Silson24 enables users to submit insurance claims conveniently through its mobile application or website. No membership registration is required and authentication is provided through mobile phone or iPIN. Paper-based documents including invoices, receipts, medical expense statements and prescriptions are no longer necessary because records can be transmitted digitally. Features for digitally underserved groups are also included, such as a “third party submission” option that allows children to file claims on behalf of parents, as well as submissions by guardians for minors.

All healthcare providers will be required to integrate with Silson24 to facilitate electronic transmission of claims documentation. Once integration is complete, documents will be sent automatically upon customer request, keeping administrative burden to a minimum. Participating providers will be eligible for incentives, including reductions in Korea Credit Guarantee Fund fees (approximately 0.2%p over five years) and discounts on general insurance premiums (approximately 3–5%). Consideration is also being given to incorporating these efforts into medical quality assessment indicators.

The Financial Services Commission and related agencies will continue to encourage participation from non-connected healthcare providers and EMR vendors, while also pursuing integration with online platforms such as Naver and Toss. This will enable a seamless, one-stop service ranging from insurer search to claims submission, with point-based benefits expected to be offered for platform users. Through the digitalization of claims processing, the burden of submitting paper documents will be reduced, and improvements are anticipated in claims payment speed, administrative efficiency for healthcare providers, and overall convenience for patients.

5. Outlook for the Insurance Market in 2026

According to the Outlook to Insurance Industry Growth published by the Korea Insurance Research Institute in October 2025, the Korean insurance market is projected to grow by 2.3% in 2026, with life insurance expanding by 1.0% and nonlife insurance by 3.5%. As a result, total industry-wide premiums are expected to reach KRW 265 trillion in 2026.

The life insurance sector, which experienced a recovery in 2025, is forecast to slow significantly to a growth rate of 1.0% in 2026. The growth rate of written premiums in the non-life segment is also expected to moderate, reaching approximately 3.5%, slightly below the level recorded in 2025.

<Forecast of Premium Growth (Written Premiums) in the Insurance Industry>

(Unit: %)

(Source: Korea Insurance Research Institute, Outlook for Insurance Industry Growth in 2026, Oct 21, 2025)

<Forecast of Premium Growth (Written Premium Volume) in the Insurance Industry>

(Unit: KRW trillion)

(Source: Korea Insurance Research Institute, Outlook for Insurance Industry Growth in 2026, Oct 21, 2025)

1) Life Insurance

In 2026, written premiums in the life insurance sector are projected to increase by only 1.0% compared with the previous year. Although insurers are expected to maintain their focus on selling protection-type products to secure new-business CSM, the growth rate is expected to slow significantly.

Demand for protection-type products is expected to remain on an upward trajectory, supported by the continued expansion of third-sector insurance sales driven by rising demand for health and disease-related coverage. For savings-type products, demand is likely to remain subdued given the interest rate outlook, although single-premium policies aimed at securing retirement income and achieving tax benefits are expected to maintain steady sales. Variable insurance is expected to see steady new business inflows, but overall written premiums are expected to decline due to an increase in surrenders as policyholders seek to realize investment gains.

<Forecast of Written Premiums and Growth Rate in Life Insurance>

(Unit: KRW trillion, %)

(Source: Korea Insurance Research Institute, Outlook for Insurance Industry Growth in 2026, Oct 21, 2025)

<Forecast of Written Premiums in Life Insurance by Product Segment>

(Unit: KRW trillion)

(Source: Korea Insurance Research Institute, Outlook for Insurance Industry Growth in 2026, Oct 21, 2025)

2) Non-life Insurance

In 2026, the growth rate of written premiums in the non-life insurance sector is projected to reach 3.5%, marking a moderation from 2025. Long-term non-life insurance is expected to continue expanding, driven primarily by health and accident insurance, although the pace of growth is likely to slow. In motor insurance, low growth is likely unavoidable unless premium adjustments are implemented, as the increase in insured vehicle numbers is expected to decelerate and discount riders are anticipated to expand further. General property and casualty insurance is expected to see slightly firmer growth as the drag from weak economic activity begins to ease.

<Forecast of Written Premiums and Growth Rate in Non-life Insurance>

(Unit: KRW trillion, %)

(Source: Korea Insurance Research Institute, Outlook for Insurance Industry Growth in 2026, Oct 21, 2025)

<Forecast of Written Premiums in Non-Life Insurance by Product Segment>

(Unit: KRW trillion)

(Source: Korea Insurance Research Institute, Outlook for Insurance Industry Growth in 2026, Oct 21, 2025)

Following the introduction of IFRS 17, the growth of the Contractual Service Margin (CSM), a key indicator of financial soundness, is expected to slow markedly. Life insurance CSM is projected to decline from KRW 64.7 trillion in 2025 to KRW 64.3 trillion in 2026, marking a reversal from previous growth, while nonlife insurance CSM is expected to reach KRW 71.8 trillion in 2026, with the year-on-year growth rate falling sharply from 7.0% in 2025 to 2.1% in 2026. The K-ICS ratio is also expected to edge down, reflecting unfavorable factors such as declining interest rates, rising surrender rates and elevated loss ratios, although the extent of the decline is likely to vary according to each company’s risk-management capabilities.

The Korea Insurance Research Institute highlighted that the industry is likely to experience negative impacts sequentially—first on financial soundness, followed by profitability, and ultimately on growth potential. Following the deterioration in solvency observed in 2024, a more pronounced decline in profitability is expected through 2025 and 2026, and over the longer term, insurers may face a tangible slowdown in growth as their risk-protection capacity and ability to respond to future developments weaken. The Institute warned that 2026 will represent not merely a period of slower growth, but a turning point in which profitability pressures intensify following the deterioration in financial soundness, adding that if corrective actions are delayed, the industry’s overall growth potential could be impaired.